ALBANY, N.Y. — Hospitals and other health care providers in New York would be banned from reporting medical debt to credit agencies under a bill passed this week by the state's legislature — a measure intended to limit the damage that illness and injury can do to someone's financial health.

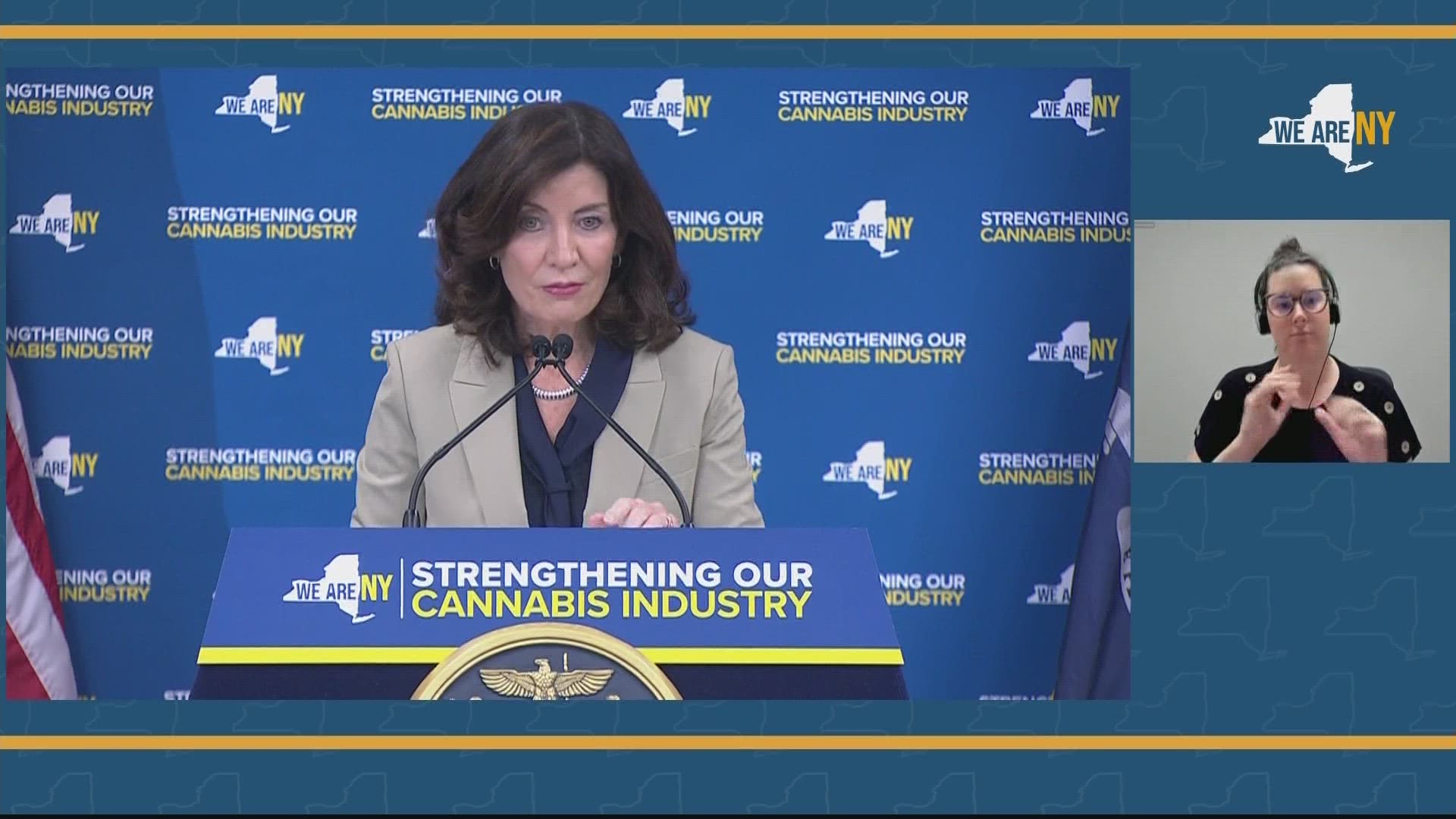

If signed by Gov. Kathy Hochul, the law would make New York the second state, after Colorado, to prohibit medical debt from being collected by credit reporting agencies or included in a credit report.

National credit reporting agencies had already voluntarily agreed to not report medical debts under $500, but advocates say additional protections are needed.

A bad credit report often means difficulty renting a house, buying a car, or securing a loan. And unlike someone whose credit is damaged by reckless spending or a bad investment, people often find themselves hit with huge, unexpected medical bills simply because they've suffered from disease or injury.

“Medical debt is different than other debt. It’s spontaneous. It doesn’t reflect someone’s credit worthiness,” said Assemblymember Amy Paulin, a Brooklyn Democrat.

In at least a dozen states, lawmakers have introduced legislation aimed at curtailing the financial burden that comes with medical debt. Some of those bills would keep medical debt from tanking credit scores and create medical debt relief programs, while other proposals would protect personal property from collections.

Colorado’s law stops medical debt from being included on credit reports and factored into credit scores, except under very narrow circumstances.

An estimated 100 million Americans have amassed nearly $200 billion in collective medical debt, according to the Kaiser Family Foundation.

New York's legislation would impact about 740,000 adult New Yorkers and their families who had medical debt in collections on their credit reports as of February 2022, according to a study done by Urban Center, a think tank that conducts economic and social policy research.

Some Republican lawmakers fear the legislation could have unintended consequences.

Republican Assemblymember Josh Jensen, who voted against the bill, said that while there is a need to ensure emergency medical debt doesn't haunt people, the legislation is too expansive and should not apply to non-emergency care.

“There's a concern that people could incur an amount of debt with no intention to pay it back, rather than the intended reasoning of the legislation to ensure people who need that critical care can get it without worrying the debt will follow them around forever,” said Jensen.

The bill would go into effect immediately if signed by Hochul, a Democrat.

“Medical debt is a serious problem that creates a crushing burden for many New Yorkers and unfairly undermines their financial security,” Chuck Bell, advocacy program director for nonprofit Consumer Reports, said in a statement. “This bill protects the right of New Yorkers to obtain the health care services they need without fear of having their credit records unfairly ruined.”