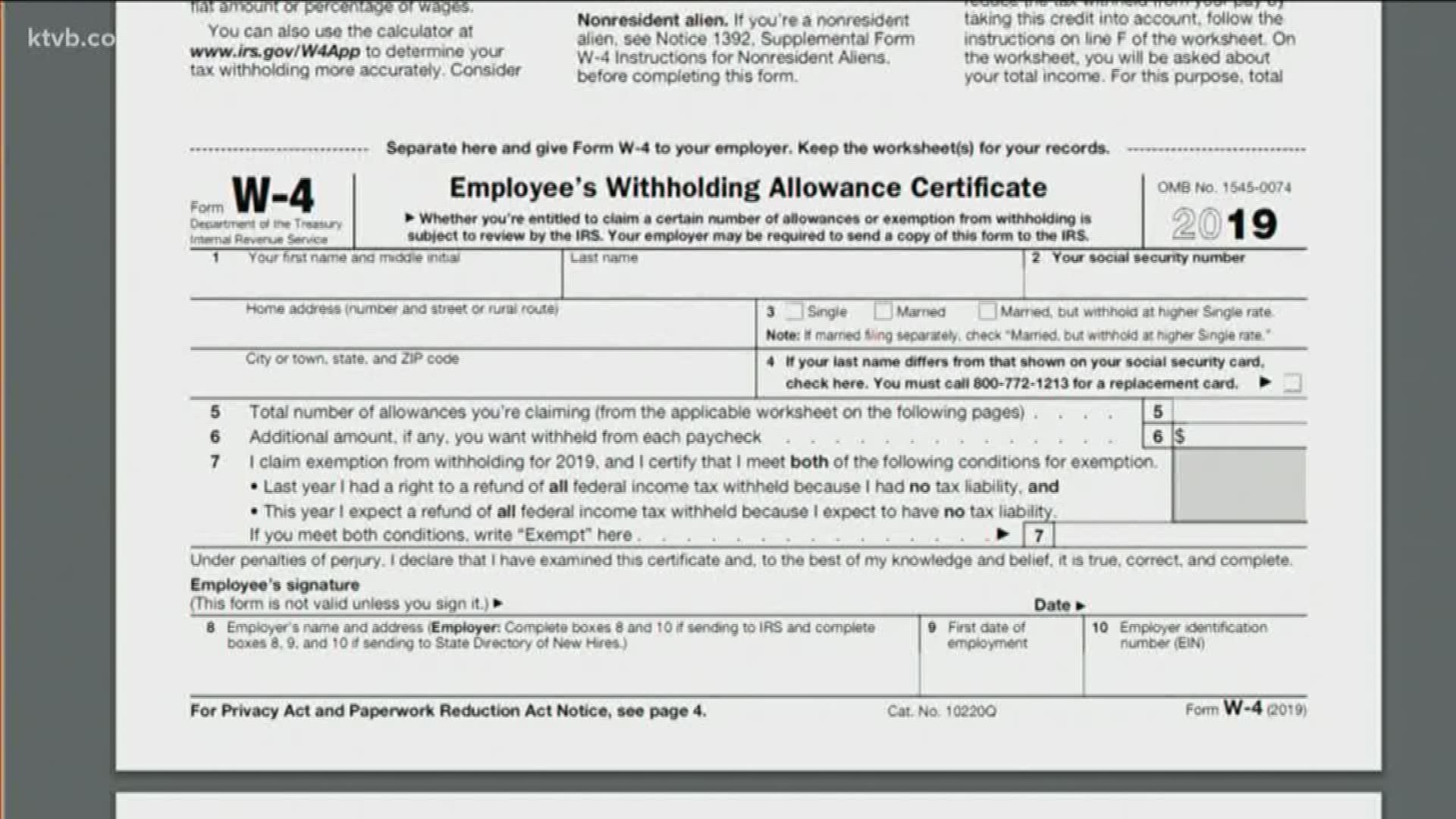

BOISE, Idaho — Tax season is right around the corner, and although we just started 2019, the Idaho State Tax Commission is urging everyone to review their W-4 forms so they don't end up paying more taxes next year.

New tax laws have changed how income taxes are withheld from your paycheck.

But before you get too concerned, just know any changes you make now won't impact your taxes come April.

“What it means for these people in Idaho if they haven't changed their W-4, if you go out and actually walk through the federal calculator, you could significantly change the amount of withholding or number of allowances that you have on your W-4,” said Cynthia Adrian, tax policy specialist with the Idaho State Tax Commission.

In prior years you may have had one allowance for yourself, one for your spouse and one for your children, so you'd end up with three or four.

“Now, the way the calculator and the worksheet for the feds works, you could end up with 10 or 11 and if you do that for Idaho, you would have zero withholdings,” Adrian said. “So you're going to have income that's taxable but no withholding, so when you go to file your tax return there is income that's taxable, nothing to go against it, so you're going to owe tax.”

The changes stem from the recent federal tax reform and some changes in Idaho at the state level.

“The federal tax reform, when that happened, it almost doubled the standard deduction,” Adrian said. “The personal exemptions and dependent exemptions went away. Idaho also had a tax rate reduction and they instituted the Idaho child tax credit for the first time ever.”

If you're single and don't have any children, you may not need to make any changes.

“But for those people who have children especially, for people who both spouses work, they definitely need to go look at it,” Adrian said.

When done, line five of your tax form should have two numbers.

“So you'll have a federal number, draw a slash and put an Idaho number, if you do the same number for Idaho as you do federal you may have not enough withheld, and when it comes tax time you're probably going to owe tax,” Adrian said.

The Idaho State Tax Commission says now is the time to make those changes.

“I would encourage everyone to go out and look at your W-4 and see if there is anything you need to do so you don't have an unwelcome tax surprise when you do your tax return,” Adrian said.

There is a worksheet that will help walk you through how to make those changes to your W-4. Once you've gone through the worksheet and made the necessary changes, you'll need to give it to your employer.