BOISE, Idaho — Mortgage rates are spiking again.

A few weeks ago, we told you mortgage rates certainly wouldn't go down, because the Federal Reserve was keeping its key interest where it was, to try to slow down inflation. The latest numbers show inflation not slowing down, but actually heading in the wrong direction, which means rates are also not dropping. Instead, they’re spiking.

Dominic Chu, a CNBC Senior Markets Correspondent, said, "The Fed cannot move to lower interest rates when prices are still showing signs that they could be trending higher."

So, the Fed will not cut that key rate, and it doesn't look like a cut is coming any time soon. That rate influences mortgage rates, so how are they looking with this news?

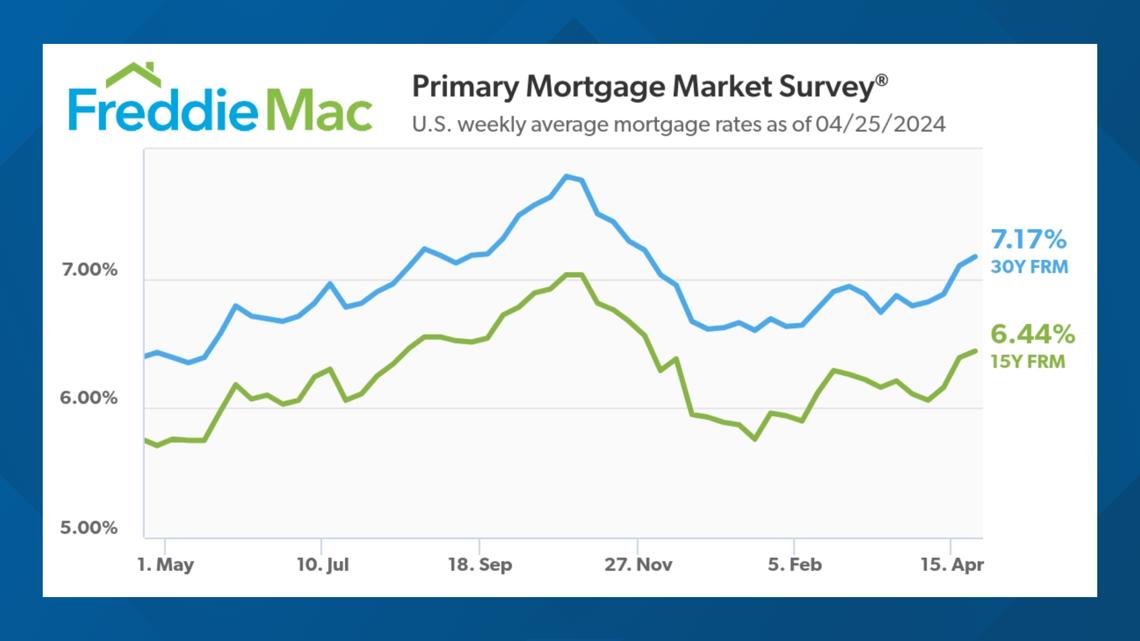

According to Freddie Mac, the average 30-year fixed rate is up over 7 percent. They haven't been this high since November. Some folks thought we might not see rates that high again in a long time. Instead, here we are just a few months later. What is that doing to growth and the local real estate market?

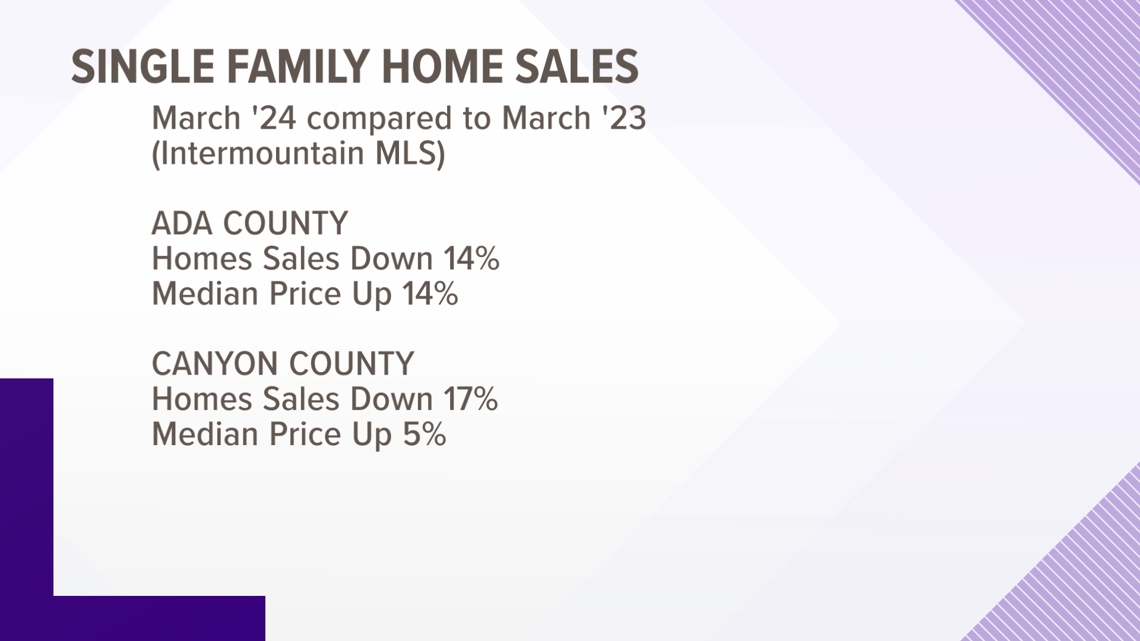

It's still a cool market, according to the Intermountain MLS. The number of homes sold last month is down 14 percent in Ada County and 17 percent in Canyon County, when you compare it to March of last year. That's while the median price is up 14 percent in Ada and 5 percent in Canyon. So, home prices keep going up, when you pair that with rising mortgage rates, buying a home is just unaffordable for a lot of people, which is why we see that drop in sales.

So, what can you do, if you're looking to buy? We need to remember that the average rate is over 7 percent. You can do some things to get a better mortgage rate.

Business Insider says first, the better your credit score, the better your rate. So, pay your bills on time, obviously, which will help that credit score. Also, your debt-to-income ratio is a big factor in what kind of rate you get, so if there's any way you can reduce debt, do it. The more you're able to save to make a down payment, the lower the rate can be. Also, there are different types of mortgages that will get you a lower rate. VA loans, for instance, can have a rate half-a-percentage point lower. And finally, the length of your loan term affects the rate. You'll get a better rate on a 15-year loan.

The average rate for a 15-year loan is sitting at about 6.44 percent right now. But by paying less on the interest, you're going to be paying more on the principal. So, you end up paying more overall monthly, but less in the long run. Again, that’s unaffordable for a lot of folks.

Watch more Local News:

See the latest news from around the Treasure Valley and the Gem State in our YouTube playlist:

HERE ARE MORE WAYS TO GET NEWS FROM KTVB:

Download the KTVB News Mobile App

Apple iOS: Click here to download

Google Play: Click here to download

Watch news reports for FREE on YouTube: KTVB YouTube channel

Stream Live for FREE on ROKU: Add the channel from the ROKU store or by searching 'KTVB'.

Stream Live for FREE on FIRE TV: Search ‘KTVB’ and click ‘Get’ to download.