BOISE, Idaho — As Spring begins and the temperature heats up, lots of folks are hoping the real estate market heats up too. That can be the norm this time of year, but the first step is falling mortgage rates.

Nationwide, mortgage demand is on the rise, thanks to interest rates coming down. In fact, the Mortgage Bankers' Association says mortgage applications rose by more than 7% week over week. But those are national numbers. Locally, it’s much more a mixed bag.

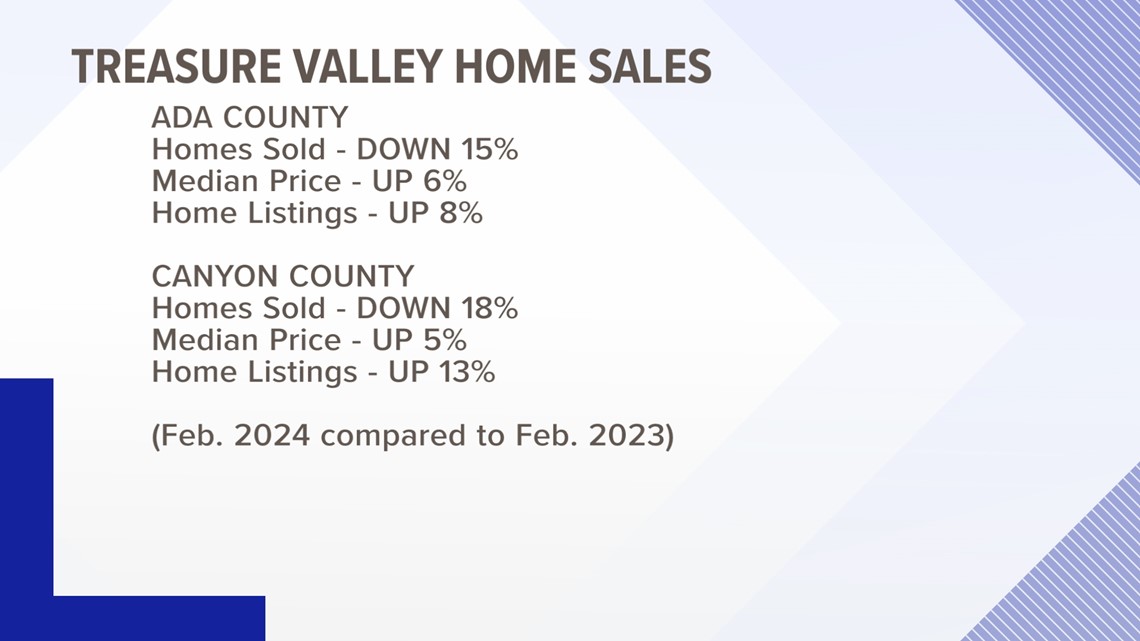

Treasure Valley Home Sales:

Here are the stats for February of this year compared to last year, according to the Intermountain MLS. Homes sales are down in Ada and Canyon County, 15 and 18% respectively. So, it's still a cool market, if you look locally and compare it to last year. All that's while home prices are up, 6% and 5%. Why?

It seems that there's still not enough homes for folks wanting to buy. Even though inventory is up 8% and 13% in Ada and Canyon County, it's not up enough. Those inventory numbers need to spike. And that could happen. If people keep putting more homes on the market, then things locally could start to echo that warming national market. That’s especially if those mortgage rates continue to fall.

But they're going to need to fall faster. According to Freddie Mac, the average 30-year fixed rate is 6.74%. That’s coming down. It's 0.14% lower than a week previous, but up by the same amount from a year ago.

We cannot say for sure what rates will do, and if this trend will continue. But mortgage rates normally follow the lead of the Federal Funds Rate, which is directly controlled by the U.S. Federal Reserve. Its Chair, Jerome Powell, told Congress recently that he expects rates to start coming down sometime this year. He would not say when exactly, because the Fed wants inflation to sit at about 2% and it's still higher than that right now.

He admits that waiting too long to drop the key rate could stunt the nation's economic growth, but doing it too early means they may have to jack that rate back up. Either way, Chairman Powell said they're not looking to do anything with it right now, "In considering any adjustments to the target range for the policy rate, we will carefully assess the incoming data, the evolving outlook and the balance of risks. The Committee does not expect that it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2%."

So, they need more data before they do anything, which means, likely, mortgage rates will not move up or down much this Spring. Which means, if the local market is going to change, we'll have to see movement in other factors besides mortgage rates. Like maybe, more homes at more affordable prices, and that can be helped with just more homes overall.

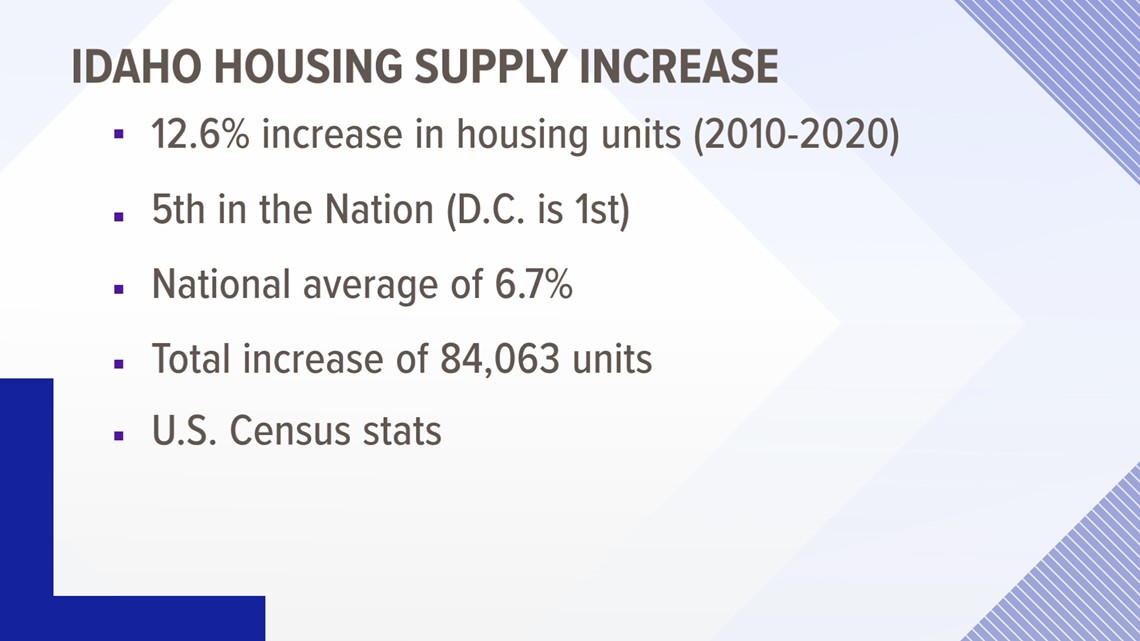

Idaho Housing Supply Increase (U.S. Census stats):

And it's not like builders haven't been building and developers haven't been developing. According to Census numbers, there was a 12.6% increase in the number of Idaho housing units from 2010 to 2020. That's 5th in the nation, and almost double the national average. It's a total increase of more than 84,000. Which is great, but again, not enough.

Watch more Local News:

See the latest news from around the Treasure Valley and the Gem State in our YouTube playlist:

HERE ARE MORE WAYS TO GET NEWS FROM KTVB:

Download the KTVB News Mobile App

Apple iOS: Click here to download

Google Play: Click here to download

Watch news reports for FREE on YouTube: KTVB YouTube channel

Stream Live for FREE on ROKU: Add the channel from the ROKU store or by searching 'KTVB'.

Stream Live for FREE on FIRE TV: Search ‘KTVB’ and click ‘Get’ to download.