BOISE, Idaho — Over the past 12 months, more than 40 million Americans and tens of thousands of Idahoans have received some form of unemployment, meaning they have also received unemployment benefits and paid taxes on them.

More than one-third of people who collected unemployment did not know the funds were taxable.

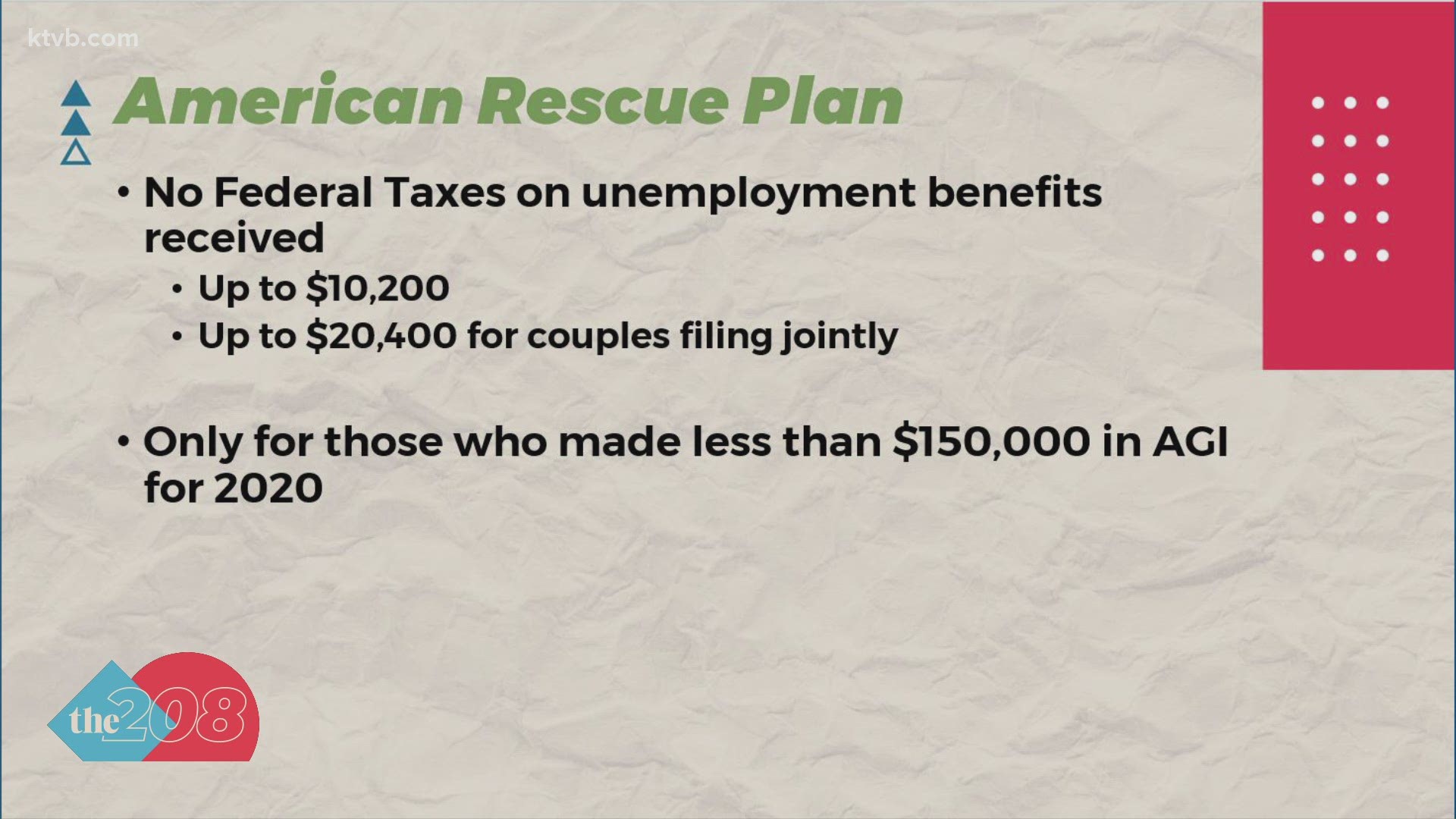

Typically, in a non-pandemic year, those who filed for unemployment would pay taxes on that income at the end of the year. However, President Biden's $1.9 trillion COVID-19 relief bill signed into law last week eliminated federal taxes that would normally be paid on unemployment payments.

The taxes were eliminated at the federal level, but not the state level.

There are 15 states that do not collect taxes on unemployment benefits, nine of which do not collect any form of state income tax. Additionally, there are three other states that recently passed temporary legislation that would make 2020-2021 exempt from state taxes on unemployment.

Idaho is not one of those states.

However, federal taxes will not be paid this year on unemployment benefits from 2020 as part of a special provision of the American Rescue Plan.

If you received less than $10,200 in unemployment in 2020, that money will not be taxed this year. If both you and your spouse lost your job and you are filing a joint tax return, that limit can reach nearly $20,400.

Idaho taxes unemployment benefits at the same level as the federal government, but that doesn't mean those benefits will not be taxed at the state level.

The Gem State will still be collecting taxes on any unemployment checks received last year, according to the Idaho Tax Commission.

While Idaho does conform to the internal revenue code as of January 1, 2021, the American Rescue Plan was not passed until March 11. This means Idaho does not have to conform to the tax provisions in the act

In order for the state to not collect taxes on unemployment benefits, legislative action would be required. No action is lined up at this time, but Senate Bill 1182, sponsored by Sen. Christy Zito (R-Hammett), would lower the maximum number of weeks one can collect unemployment from 26 to 20.

Join 'The 208' conversation:

- Text us at (208) 321-5614

- E-mail us at the208@ktvb.com

- Join our The 208 Facebook group: https://www.facebook.com/groups/the208KTVB/

- Follow us on Twitter: @the208KTVB or tweet #the208 and #SoIdaho

- Follow us on Instagram: @the208KTVB

- Bookmark our landing page: /the-208

- And we also turn each episode into a podcast or Podbeam

- Still reading this list? We're on YouTube, too: