BOISE, Idaho — This article originally appeared in the Idaho Press.

In a near-party-line vote after an hour and a half of debate, the Idaho House on Tuesday approved the largest tax cut in state history, sending the bill over to the Senate.

HB 436 provides a record $600 million in tax cuts and rebates, surpassing last year’s similar legislation. It includes $350 million in one-time rebates and $251 million in ongoing income tax rate reductions for individuals and corporations.

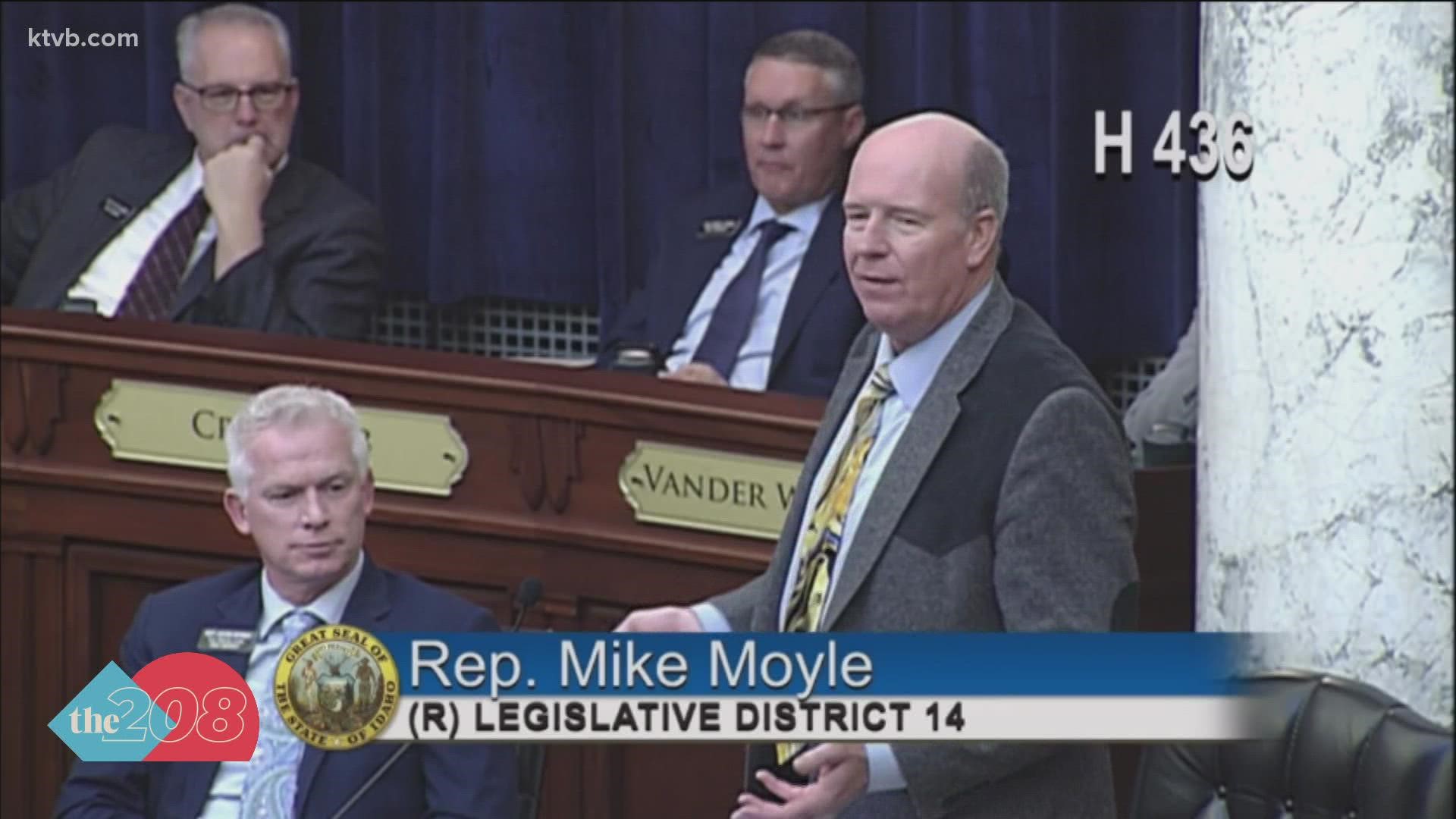

House Majority Leader Mike Moyle, a lead co-sponsor of the bill, hit back against concerns that the bulk of the benefit would go to corporations and the wealthiest Idahoans. “It’s really hard to cut taxes for people who don’t pay taxes,” he declared.

“We have some of the highest income tax rates in the nation and they start at a very low level,” he told the House. “That has an effect at businesses looking to come to Idaho. … Those businesses want to make money. When they make money, they pay higher wages.”

HB 436 has moved with great speed; it was introduced within days of the start of this year's legislative session last week; had its hearing and cleared the House tax committee on a party-line vote on Tuesday; and then came up for consideration in the full House on Thursday. To become law, it would need to pass the House, clear a Senate committee and the full Senate, and be signed into law by Gov. Brad Little, who highlighted the proposal in his State of the State message and has indicated strong support.

Just one Republican, Rep. Fred Wood, R-Burley, joined every House Democrat in opposing the bill. Wood told the House that when the state has more revenue, it should invest in infrastructure for the long term. “What we’re about to do is cut the revenue stream that will allow us to do this into the future,” he said. “This kind of smells a little bit like the way Congress operates, and not the Idaho Legislature.”

Opposition to the bill came from minority Democrats, with House Minority Leader Ilana Rubel, D-Boise, saying, “Every time this legislature has two dimes to rub together, this is what we see. ... The wealthy and well-connected are showered with money and there are scraps for the people that need it.”

She pointed to property tax relief and removing the state’s sales tax from groceries as higher priorities for Idahoans, and said, “I’m standing up against this bill today because I want tax cuts. I just want tax cuts that will actually help people ... tax cuts that correlate to what people actually want."

Rep. Bruce Skaug, R-Nampa, said, “Things are not so dire as I have heard. ... This year we can have our cake and eat it too.” He noted that there’s a clause in the bill for those who don’t want the money. “You can go through the Tax Commission ... and donate your money to the public schools or other good things. I encourage people to do that.”

Rep. Caroline Nilsson Troy, R-Genesee, said, “I’m really tired of hearing about how terrible millionaires are.” After working for years as a fundraiser, she said, “The millionaires in Idaho are not trust-fund babies. They earned that. They weren’t given it, they weren’t handed it, they earned it. … By God, this state has benefited from our millionaires, and I’m grateful for them.”

Rep. Tammy Nichols, R-Middleton, said while she's supporting the bill, “It’s not my favorite. … I’m hoping, hoping, underlining hope, that we’ll hear more. … There’s a lot of taxes we can cut.” She said, “I’m hoping that we can do a lot more and a lot better.”

This is a developing story and will be updated.

This article originally appeared in Idaho Press. Read more at IdahoPress.com

Watch more Idaho politics:

See all of our latest political coverage in our YouTube playlist: