BOISE, Idaho — A bill that would have significantly increased the Idaho sales tax to offset a deep property tax cut for Idaho homeowners' primary residences appears to be dead in the Senate this year.

The Idaho Senate Majority Caucus on Friday afternoon released a statement saying the Senate's Republican leadership will not pursue advancing House Bill 741 this session.

"It has been a long-term effort of engaging numerous stakeholders representing the interests of business, communities, and citizens throughout Idaho. Through that effort, we were able to arrive at this consensus legislative solution. However, there are many moving parts to achieving the desired successful outcome that require attention. Primarily, in order to maintain our commitment to sound fiscal policies, we need to analyze the impact these changes will have on our State over the long run. But we're running out of time in this Legislative Session," the senators said in the opening paragraph of their statement.

The bill was introduced Friday, March 4, and referred to the House Revenue and Taxation Committee. It would remove all property taxes except voter-approved bonds and school levies from primary residences that receive the homestead exemption (also known as "homeowner's exemption"). Also, the bill calls for increasing the grocery tax credit to $175 per person, and increasing the state sales tax from the current 6% to 7.85%, with 1.65% dedicated to local taxing areas -- including cities -- and 0.2% used to increase the grocery credit. The fiscal note attached to the bill indicated it would reduce general fund revenue by $12.16 million.

Sen. Jim Rice, R-Caldwell, and House Majority Leader Rep. Mike Moyle, R-Star, put the bill forward. Friday the Senate Majority Caucus, which includes Rice, said HB 471 will instead "be the tool needed to continue this conversation so that all voices are heard, all numbers are analyzed, all models are perfected, and all concerns are given thoughtful consideration...

"The result will be a long-term solution. It is not an election-year stunt or a fly-by-night plan that will never become reality," the senators' statement continued. "This is the beginning of making major improvements to the tax structure of our State."

After the bill was introduced, The Idaho Center for Fiscal policy released their report, which includes concerns that the legislation could create a situation for renters and low-income families where they see “a tax hike of potentially hundreds of dollars but no reduction in their housing costs.”

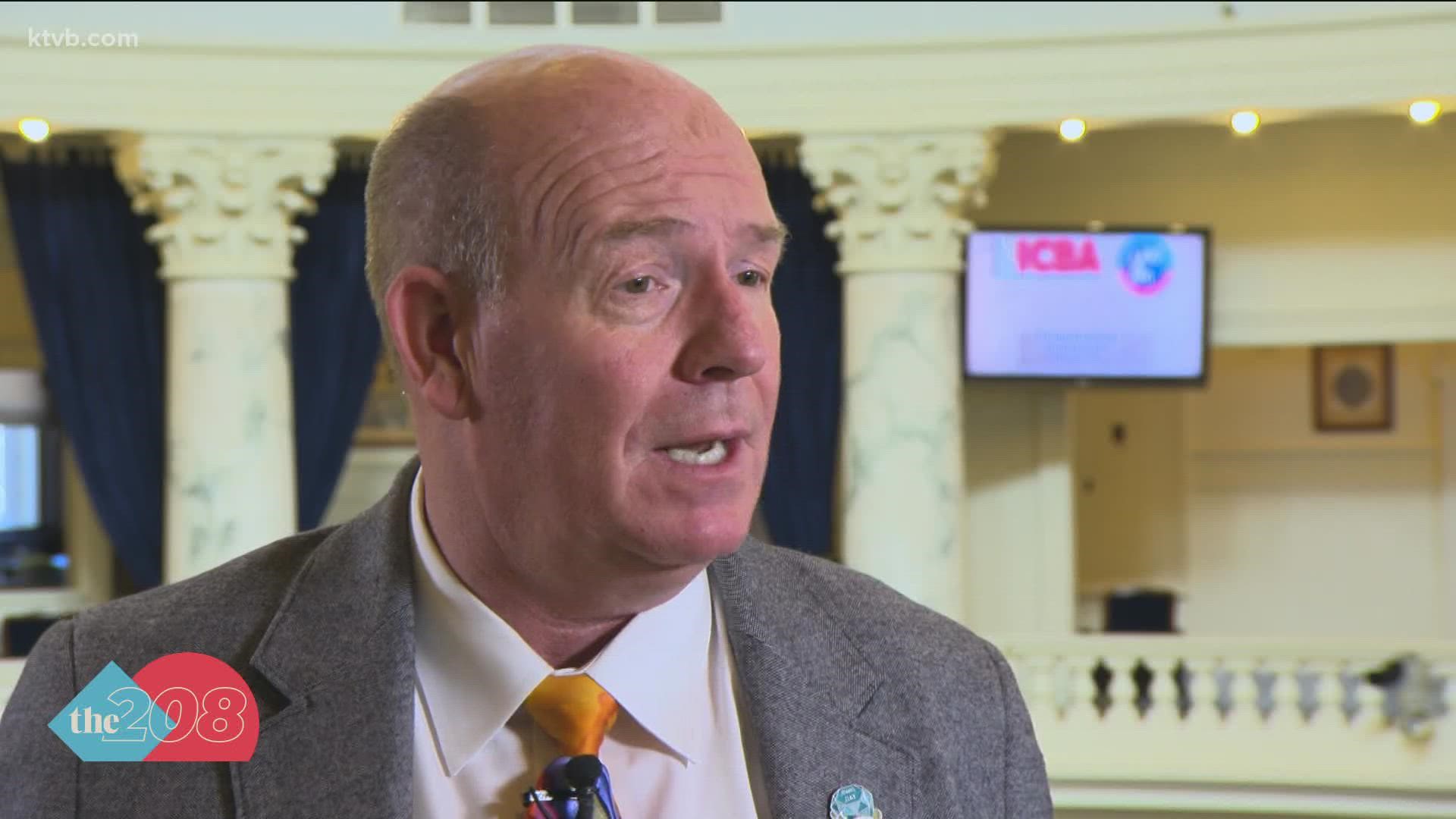

In an interview with KTVB for a story that aired Thursday, Moyle acknowledged that the proposals in HB 741 would shift the burden to the sales tax, "but it's a tax you can avoid if you choose to," he said, alluding to the fact that the sales tax is only levied when someone chooses to purchase goods or services.

As of Friday, March 11, HB 471 had not advanced beyond the House Revenue and Taxation Committee, and the Senate Majority Caucus announcement that it will not pursue the legislation this session makes any further action unlikely until next year.

Watch more Idaho politics:

See all of our latest political coverage in our YouTube playlist: