BOISE, Idaho — A new idea pitched at the Idaho statehouse is to eliminate property taxes to help Idahoans struggling to keep up.

House Bill 741 would remove all property tax other than voter-approved bonds and school levies from primary residences that receive the homestead exemption, that is the technical name of the homeowner's exemption.

The bill would also raise the grocery tax credit by $75, from $100 up to $175 per person. The tradeoff comes with a sales tax increase of 1.85%. That would increase the sales tax from 6% to 7.85%, with a portion of that going to local taxing authorities who currently collect property taxes.

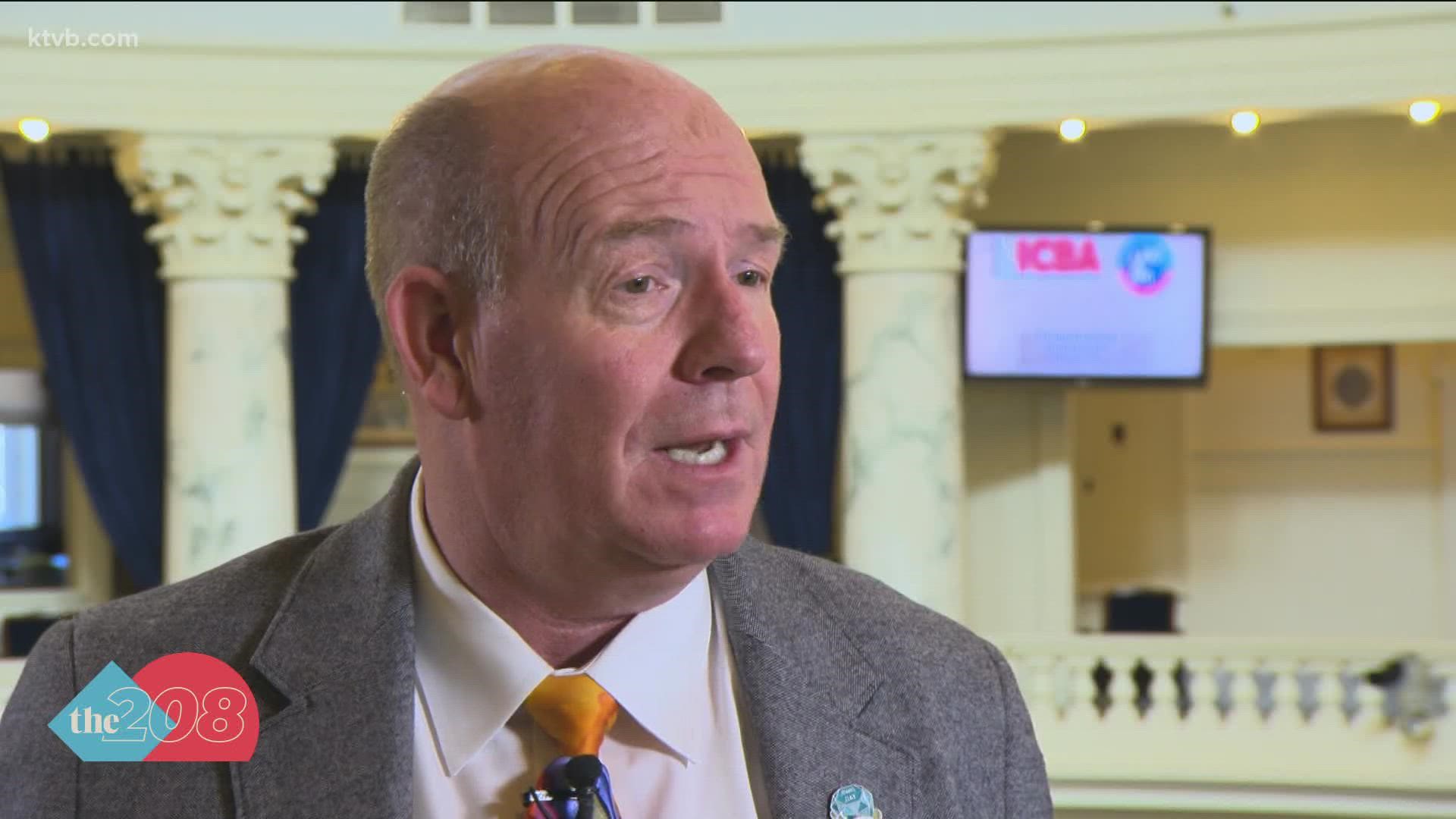

“It will help keep people in their homes in Idaho. It'll help our elderly. It'll help people who are trying to buy a new home. It does shift the burden a little bit over to the sales tax, but it's a tax you can avoid if you choose to,” said bill co-sponsor, House Majority leader, Republican Rep. Mike Moyle.

Rep. Moyle is co-sponsoring the bill with Senator Jim Rice. Moyle says the idea is to shift taxes in a manageable way for homeowners struggling with property taxes.

“It does benefit, especially our elderly. Think about your grandmother. She's not spending a whole lot on sales tax. Now, all of a sudden, her property tax is going to go down 70, 80%. That's huge to them. It will help keep them in their homes, and at the same time, it will help those who are just starting out, be able to afford a home,” Moyle said.

Critics argue the idea is unfair to people who don’t own homes but will see sales tax go up. Moyle has this response:

“Renters are in a bad place because they're price takers and right now we don't have enough rentals, which is one of the reasons prices are so high on rentals. But it does help renters. They get an increase in the credit to get another $75 for each one of them there,” Moyle said. “They also will get the added benefit, if they choose to buy a home, it will be easier for them to buy a home because their purchasing power goes higher now that they're not paying all that money for property taxes.”

The Idaho Center for Fiscal policy released their report on the idea, sharing concerns about the concept. The report highlights, among other points, that the idea could create a situation for renters and low-income families where they see “a tax hike of potentially hundreds of dollars but no reduction in their housing costs.” The report concludes, “We do not support House Bill 741 due to its negative impacts on low and moderate income Idaho families and overall disparate approach to property tax relief.”

Moyle says he understands the concerns but argues it is a net benefit for most Idahoans. In the spirit of transparency and education on the bill, Moyle says they are working on a tool that Idahoans can use to see how the idea would impact them.

“We're going to try to get a website online so people can go put in their property taxes and it'll show them what it saves and what they'll get back from the increased credit and from the lowering of the property taxes so people can understand it's going to put more money in most people's pockets, hundreds of dollars in some cases a month,” Moyle said.

A major question from critics is: with the shift, who would be left responsible for making up the difference? Would some group be “left holding the bag?”

“I think, who's ever making the purchase on sales tax? Are you going to go buy a Mercedes? You're going to go buy Honda," Moyle said. "You're spending habits will determine who's going to pay the bill? Another thing that people don't realize about the sales tax is that we are a destination state. There are a lot of people that come here to recreate. I have friends who have Airbnbs here. And there are people in those things every weekend that come here. For a week or two or a month. And they're paying sales tax and they're paying sales tax on the stuff they buy. When they hear they're paying sales tax on Airbnb, when they're here, they are paying the tax the best taxes when somebody else pays."

The legislation is in preliminary process at the Statehouse as lawmakers are starting to wind down for the session. Moyle says it’s possible the bill makes progress in the 2022 session but is more likely a concept that people will need to research and be prepared to discuss in 2023.

Watch more Local News:

See the latest news from around the Treasure Valley and the Gem State in our YouTube playlist: