DALLAS — I know a lot of you are all caught up in the NBA Finals right now. Being a money guy, I was watching the other day and thinking of what a great job it must be to play professional basketball — and the benefits ain’t bad, either.

You know how a lot of us have 401(k) plans at work where our employers match our contributions up to 3, 4, 5 or 6%? The NBA matches player 401(k) contributions up to 140%!

Unless you have a future in professional basketball, that should be incentive to increase what you are putting away for retirement. Vanguard’s latest report says most of us are not ready for our golden years.

It showed the average retirement account balance was a little more than $106,000. But that average was dragged upward by relatively few account holders who had saved much more than that amount. More than half (58%) had a nest egg worth less than $40,000. A third of people had less than $10,000 saved.

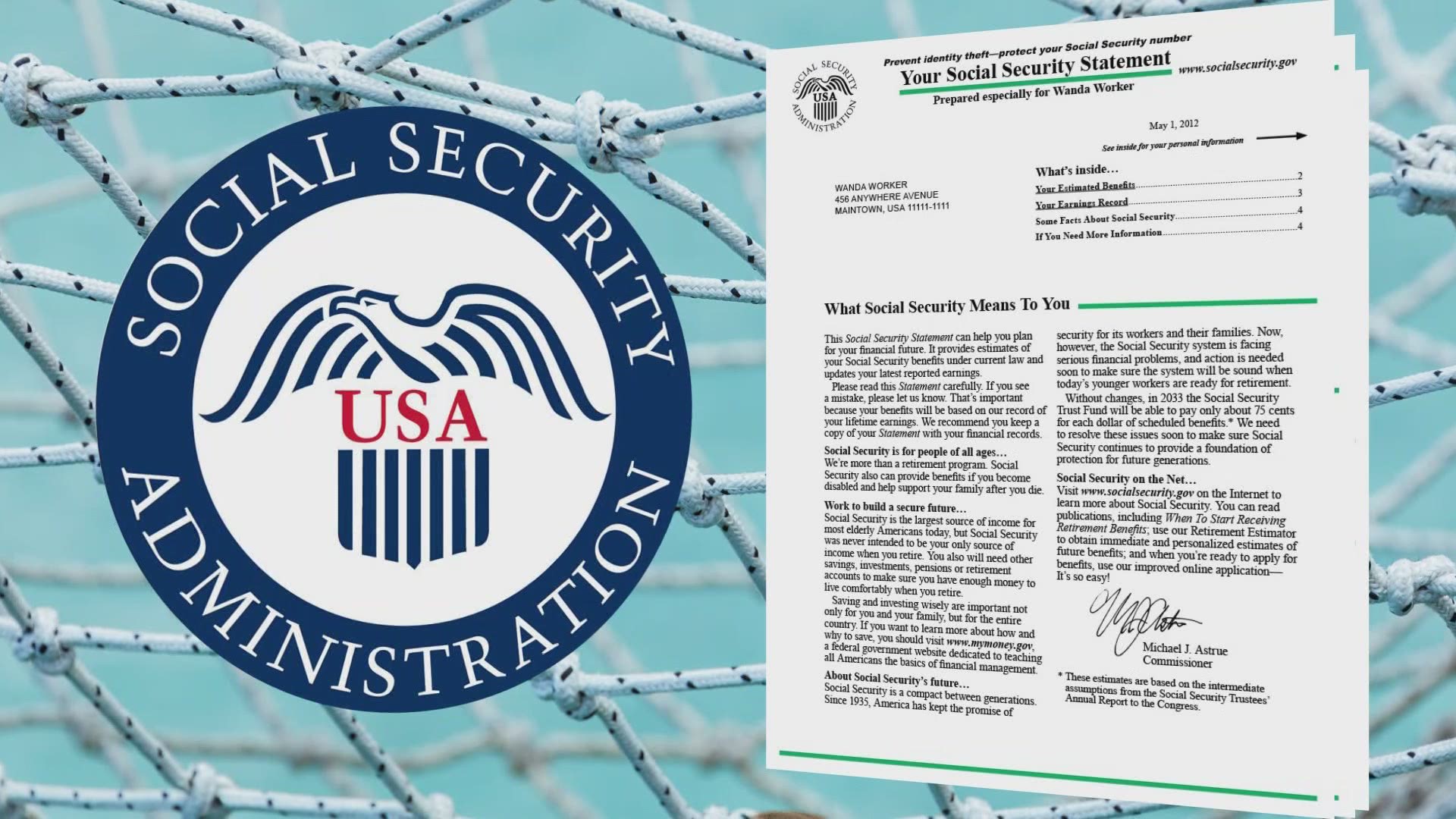

Social Security check-up

Are you depending on the safety net that is Social Security? If so, how much do you plan to get from that each month? Years ago, the Social Security Administration sent us regular updates on our estimated future benefits, which change all the time. The amount you will eventually receive is based on the 35 years in which you earn the most.

They’re no longer mailing your estimate to you, but you can easily get it. Create a login with Social Security. Sign in, and it’ll tell you if you have worked enough already to eventually get a monthly benefit. The site will also reveal what your monthly payment is likely to be, based on your actual earnings history.

You can also drag an interactive bar to see how much less you would get if you draw social security early at 62, versus waiting for the maximum payment you would get by waiting until you’re 70 to tap Social Security. You can print your information or save it and come back every year to re-check.

And remember, it may be advantageous for you to check the benefit you would receive by claiming Social Security under your spouse, ex-spouse, or deceased spouse.